A few of the biggest mistakes and misconceptions in health startups

Just a fools observations...

Hey friend!

New here? Want to join >2200 health tech & innovation loving legends in getting the latest and greatest insights and updates? Hit subscribe and join us 😊

Over the past year(s) I’ve spent far too much time talking to entrepreneurs, entrepreneurs, industry and investors.

In startup world, there’s a lot of noise and BS. Which can be darn hard to break through. So now sitting firmly (lol, it’s been like a second) in the investor seat - I thought it was time to clear up a few common misconceptions I see on the daily.

DISCLAIMER: These are a few of my observations and views. Everyone is different and take my word at your own peril. Disagree with what I’ve written? Epic - hit reply and let me know!

PS - Since a few people seemed to have missed it, I want to make something abundantly clear

I am investing in and working with fab founders as an Angel & with epic “real investors” at Side Stage Ventures (wew!)

So if you are doing something cool, or know someone who is. Give me a shout 🙌 😊

What can I help with?

Insights into the health and investment space

Networks and introductions

Distribution

Marketing, brand and value prop

Cool 😊 Now before we get to it, a word from some legends over at…

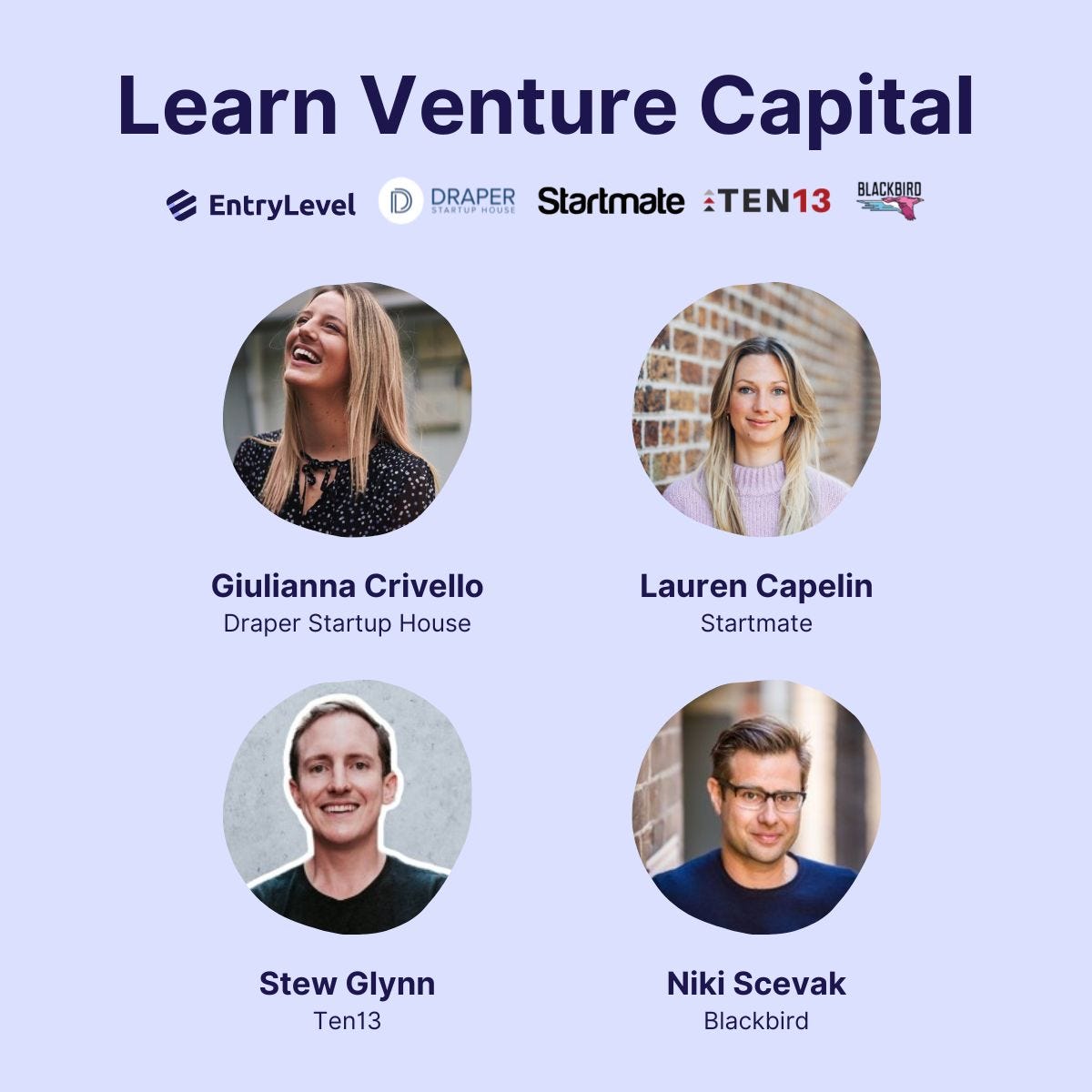

💜 EntryLevel

Curious about Venture Capital?

Want to learn the basics from the best in the biz? On your terms?EntryLevel’s epic new course helps you learn all about VC in 6 weeks.

Gain practical skills and insights into how the industry works, or to get prepped to try transition in. It covers - Understanding what Venture Capital is, Market and Trend Analysis, Evaluating Companies, Due Diligence & How to Break in. I sure as hell wish I had this instead of having to hack it all together…. 😂

All for $100USD… AND if you finish it within 6 weeks, you get a full refund! WTF?! Must be a trap (but it’s not - can verify they are real humans and actually pretty ace).

Disclaimer: I get some moneys from these to keep What the Health running and free for you all. Keen to get featured ft. ads or sponsorship? Take a look here or flick me a note 😊

Here we go…

1) Funding ⍯ Winning

This “sexy” measure of supposed success is one of the biggest misconceptions out there. But, raising capital, or a big round which the press made a hoo-ha over - does not necessarily mean a company is winning.

At least at what matters.

Yes, it’s often crucial - with usually, large amounts needed for health ventures. And to be celebrated. But nothing can beat execution, product, customers and true outcomes.

The reality is you will never know the full story behind the curtain of companies… The dirty details. The close calls. Sacrificed equity, control, or sanity. How many startups have big press releases then disappear never to be seen again? Or raise crazy numbers just to crash out spectacularly? *Cough* Theranos

Getting funding and building are two very different games. But if you do both well, that’s a winning combo.

TLDR - don’t let it dishearten you2) It's a Relationship Game

All of life is. Yet some seem to forget this.

People usually want to help, work with, and invest in people they like and/or respect. But relationships take time. So start early. And be human. You never know who, or what will be useful or lead somewhere amazing.

Especially from the investment perspective. Investors often like to get to know you and build conviction - as what you’re really investing in when you invest in a company is the people building it. Ideas are a dime a dozen, and execution is everything.

And, you attract what you put out. So if you treat people like a transaction, they will feel it. And might not get you very far

“At the end of the day people won't remember what you said or did, they will remember how you made them feel.”

― Maya Angelou

3)Understanding what VCs actually look for…

No one will ever care for or understand your business like you. Nor should they. But to get others on board, it’s useful to think about what drives them.

VCs are looking to make big returns. Sure, help companies succeed etc too…

But at the end of the day, it’s a growth and money-making game. I.e. - you need to be building a bloody big business.

“But so many companies get funding”. Yes, but in true VC this is done with the knowledge that often only a small fraction of those will ever make a truly big return and make up for the rest of the investments. It’s this thing called the power law.

So unless it’s one hell of a big category in Australia or global - many won’t touch it.

NOTE: Every investors approach, values, expected returns and processes are different

So, make sure you do some research and know who you actually want to talk to, and how they operate.

It will save you a hell of time and heartache. They do say its like getting married after all…And, make sure you’ve asked yourself..

Do I really need, or want VC funding now?

And, is this route, or these investors the right fit for me?

4)Less is more

Concision and clarity are your friends

Quality > Quantity

This applies to well, most things. Decks. Emails. Product features (at least in the beginning). Specialist Feedback.

But it seems to be something, health companies especially - eternally struggle with.

The true valuable commodity these days is attention. And you usually win by creating a great experience. Want to win people over? Respect their time and attention. Because with decreasing attention spans - regardless of the medium, you probably have only seconds to capture it. And them.

5) Invest early in the things that matter

By the time you realise you need something, it’s often too late.

Relationships, PR, staff, funding.

It’s a lame cliche, but for good reason - foundations are everything. So if you really are in this for the long hall, it pays to lay solid ones early.

Relationships & Brands take months to years to form. Recruiting top talent takes time and serious incentives. Funding… is almost always underestimated. And can drag on far longer than you could imagine.

The good news - is by planting seeds early and investing in brand, story, relationships, culture, processes… You can speed up everything infinitely for yourself later.

It’s like compound interest. It might seem like a waste today but it sure as hell won’t be tomorrow.

6)Bigger isn’t always better

Growth is great. As are big valuations and funding rounds.

But like anything, it depends on the situation. If you grow too fast or bite off more than you can chew, you might be in for a rude wake-up call. Whether it’s going unceremoniously up in flames like Fast, your team or product breaking, or heavy expectations from investors to deliver on milestones. It can get ugly.

Especially given how hot the market was last year. Valuations in 2021 were wild.

Now there are mass layoffs, and rumours of up to 80% valuation drops in the US. And US digital health darling Teladoc has just been hit with a class-action lawsuit by investors as the share price plummets, claiming they were misled. Wild.

Last year wasn’t “normal”.

Money is great. But only if you’re ready for it and at the end of the day it’s all about what you do with it.

7)Undervaluing Brand, Messaging & Marketing

These are some of the best tools you can have in your tool kit. But it seems to be the thing many put last. And my personal pet peeve.

I know - I used to be sceptical too.

But just think… Why do you know coke? And, will you likely buy it over the 10 cheaper but unknown brands beside it?

Why are some companies getting so much PR? Or known as the place to go to work?

Because of the brand. And distribution.

People invest in, and buy from people or brands they trust. Build it and they will come is kind of BS - You know what you’re doing, but nobody else does. So how and why would others care? Thats where a strong brand, marketing & messaging can help.

8)Not tailoring your Message

Just like one size definitely doesn’t fit all, neither does one message.

Tailoring your message for your target audience, whether it is a specific customer, investor, partner and even the medium - is the best way to win.

If you are everything to everyone, then you are nothing to no one.

It’s not about you - it’s about the other person you are trying to reach.

Different horses for different courses. So don’t just blanket message or copy and paste. You are infinitely increasing your chances of being ignored.

9) Let’s talk about D*cks baby...

Decks. We’re talking about decks. And they are often… a little lacking.

If the reader doesn’t get a rough idea in 1-2 minutes of reading your deck- there’s a good chance they are not going to go any further.

Coming back to less is more. And valuing, and capturing attention… It’s best to make it as easy as humanly possible to understand.

And telling a good story, sure as hell doesn’t hurt.

Communication is a superpower. While a sign of truly understanding a topic is by distilling it as simply as possible.

“But what I do is so complicated and can’t possibly be distilled”. I know. Health and science especially are darn hard. But if you nail it - the rewards can be huge.

This could be its own little essay on how… so we’ll do this another time.

10) Don’t be a dick

The world is a small place. In the “normal” business world and medicine - coldness and savage competition is often rewarded. But not really startup land.

Why am I raising this point? Because there seems to be a lot of “traditional” operators who enter the space and don’t seem to quite get this.

Pro tip: Give first. And you’ll find what comes back will usually be far greater.

The saying you catch more flies with honey than you do with vinegar is definitely true.

11) Collaboration

Basically - You need it. With industry, stakeholders, customers and patients.

It’s one of the biggest predictors of success.

To quote the cliches from our panel at the DHF

"Teamwork makes the dream work

Community is Key

And network is your net worth”

12) Underestimating Health’s “Special” Challenges

Things for health startups are extra hard. With endless extra hurdles.

Sales processes & cycles. Regulation. Trials. It all takes a hell of a lot of time, and almost always more than you think.

But it seems in chats with investors, many either:

1) Ignore this

2) Think because there has been 1 chat about a deal, partnership or pilot it means it will happen

3) Claim to have a lil more traction than they do

Please lord, do not do this.

Avoiding “elephant in the room” like obstacles does you no favours. And doesn’t instil confidence or faith that you are the right person/people to make it happen. Best to tackle it upfront or be prepped for these questions.

That by no means means don’t be optimistic or confident you’ll get there 😊 And obviously, you’re not expected to know it all. But being aware and acknowledging the potential or current problems is a big bonus.

13) Learn about IP & Equity Early

These are two of the key fundamentals. But damn, it’s tricky.

If you partner with certain players, universities, accelerators or Ventures studios - they often set many terms or may take a chunk of either. Which could even enable them to take control. So, try know your stuff, or have people around who do.

These are things that can make or break your business. With a great impact on if you are able to raise more money, get future investors, or make your own decisions.

There’s a heap of good resources out there to help with this - like the book Venture Deals, Accelerators, Incubators, or epic industry experts.

14) Be open and have that growth mindset

This is probably the most important trait you need in startups. And life.

There’s a hell of a lot we all don’t know. And the more we know, the more we realise we don’t know.

We can learn something from everyone. And the only thing that is certain in this game, is that what you think will happen, almost certainly won’t… at least in the way you think it will.

But being open and approaching everything as a learning opportunity is a sure-fire way to get somewhere. ✨

👉 TL;DR 🎉

Money & funding isn’t everything

It’s a relationship game

Know your target audience & how the game works

Less is often more

Invest early in the things that matter

Messaging, branding and marketing are your friends

Tailor your messaging

Bigger isn’t always better

Decks, like any good first impression - matter

Don’t be a dick

Collaboration is key

Don’t overlook the elephants in the room

Know the basics before you get too far

A growth mindset is nonnegotiable

What have I missed? Disagree? Got an experience to share? Hit reply to this email or drop a comment below!

Like it? Know someone else who might? Sent it their way!

Okie dokes, catch you soon

👋 Emily