The State of Aussie Healthtech Funding

$476m funding & 3rd most popular startup category

Our friends at Cut Through Venture & Folklore just dropped their fun lil (lol +130 page) report on The 2024 State Of Australian Startup Funding 🗞️

As someone who works at a Healthtech Venture Fund (Tenmile), is an ex-generalist seed investor (Side Stage Ventures) and an obsessive healthtech nerd - I must of course give you my ramblings.

So, to save you wading through 132 pages - heres my brief round up and general take on all the health data and mentions in the report.

📚 Definitions

Before we kick off, I think its important to differentiate the different categories as often its unclear and different people use different terms.

In this report:

Healthtech 🏥 – TYPICALLY this is the umbrella term used for all health related technologies and innovations…

But in this it refers to more digital based solutions. Think telehealth, digital health platforms, consumer products & AI-driven diagnostics.Biotech 🧬 – Biology and technology to develop new drugs, therapies, and medical innovations. This includes gene editing, regenerative medicine, and vaccines.

Medtech 🏥 – Devices and equipment that diagnose, treat, or monitor health conditions. From MRI machines and pacemakers to robotic surgery tools and smart prosthetics.

Ok, now lets go…

Disclaimer on data source: This data is from Cut Through Ventures data collecions of funding data from various publicly available sources, including press releases, social media, and investor memos. Data is also provided directly to Cut Through Venture by Australian startup ecosystem participants, including investors and founders.

To be included in the Cut Through Venture data set, all deals must be validated by ASIC filings, an investor or founder involved, or via a press release citing parties to the deal.

It isn't necessarily complete nor reliable, and definitely not investment advice.🚀 General VC Landscape Observations

More deals. Bit more confidence, optimism &action than 2023. Still issues with later stage funding & LP reservations.~$4bn was raised accross 414 deals (reported) in Aus in 2024. Theres a lot of data on average round size etc but for health, and each thing its different so I’m not going to dig too much into it. But there was more confidence and bigger checks at early stages.

Most of the funding was in NSW, followed by Vic, then SA and QLD. Checks out.

AI was THE word of the year… but funds were actually yet to represent the amount of hype touted, at least here in Aus. Globally it dominated headlines with it making up a record 46.4% of the total $209 billion raised in the US.

Biotech/Medtech was the 3rd biggest funding category by quantum, with healthtech coming in 10th.

There was a lot more bridge rounds, unforuntately a fair bit of pain with a fair few company failures, markdowns in a bit of rebalancing, but some stabalisation of valuations

🗞️ Healthtech Headlines

Bio/Medtech received $347m in total funding (7.7% of funded deals)

The 3rd biggest category by $ in Aus

Healthtech received $129m in total funding (9.4% of funded deals)

Increased local Investor Capability - more local funds & players entered the scene (more below)

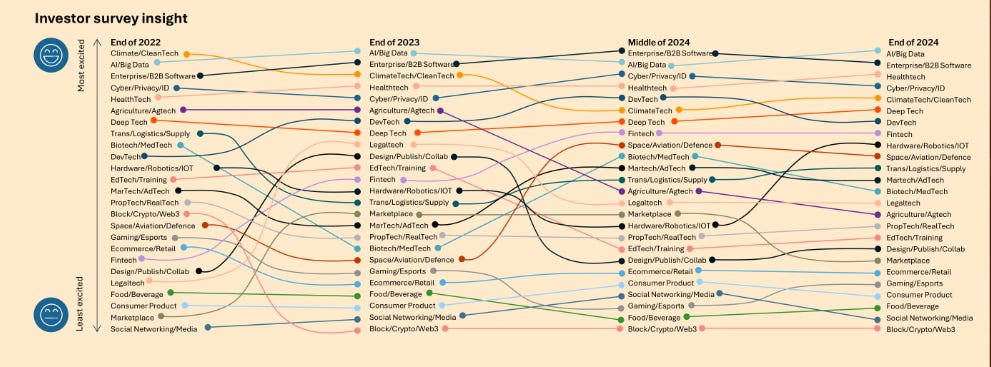

Healthtech is “Popular” - ranking the 3rd category VC investors and Angels are most excited by

Buzzwords - Aged care, longevity, mental health, femtech & AI were all name dropped generally - but they have been for a while and we’re yet to reflect this funding and company creation trend thats in the US. Bio & Therapeutics is actually getting action though.

Later Stage & Growth funding is still a big issue

Hype vs Reality - although popular, we’re still yet to see a lot of investors put their money where their mouth is

✅ Companies Who Reported Raising in 2024*

*Not necessarily complete

🔬 🧬 Can You Compare Categories?

Whilst this report lumps Biotech and Medtech together - the reality is both are extremely different, with varied capital needs, timeframes & regulatory pathways, exit timelines, multiples and options.

And this nuance is extremely important to take into account - both from an investor and founder perspective. To rank it against “normal” software based businesses or go on hearsay is an oversight. Often making it where many investors falter - leading to dissapointment, confusion and fear with a lack of understanding, milestones, risk profiles & stages, dilution and general funding requirements.

But - that being said, with the right understanding and/or insights from experts, it can be one of the most exciting and moat based categories to look at

Healthtech on the otherhand, as a category is an interesting one.

In Australia the market is generally small compared to the global stage and highly fragmented - meaning that a lot of companies just aren’t suited to VC funding. At least in the traditional sense. And whilst no doubt super important, on the global stage its still largely yet to find its feat on sustainable business models and valuations

🔍 Nuance behind the Numbers

Although the headlines may look fancy, don’t let the big numbers fool you. The truth is - you never really know whats going on behind the scenes, the round and funding composition, purpose of the capital, or actual state of affairs.

Whilst getting funding is important - we should always double click and focus more on business and clincal milestones. And, generally celebrate everyone who even gives the startup journey a crack. It isn’t for the faint hearted.

💰More Funds, More Fun?

2024 saw a heap more Health focused venture funds hit the scene. But there's still far from enough.Main Sequence release their health and bio thesis, Bupa announce thier early stage fund, Research Group WEHI publically announce their $66m fund Ten66.

Proto Axiom raised $20m into their biotech venture incubator/studio, Tenmile hit +20 investments from their $250m fund, and Brandon announced their $270m fund VI. Whilst university seed funds and Breakthrough Vic all focused heavily on research commercialisation.

This positive pouring of funds into the already strong foundations with established players like Brandon Capital, OneVentures & IP Group is a great signal.

But, the reality is - despite this, theres still a giant gap in Growth Capital beyond Series A + B in Australia. Causing growing pains and constraints, pushing companies and talent offshore.

Pair this with the long time horizons and often “non unicorn shaped” healthtech companies - we still need more patient and smart capital in Australia. And other potential players (government, industry, corporate, alt funding structures, Super funds) to ideally step up and help develop the industry - and keep capability, and talent here.

If we don’t create a solve collectively soon - we’ll likely miss the opportunity.

💡What Other Smart People Have to Say on the Healthtech Landscape…

Putting aside any impact from the US market (unpredictable at this point) it feels like 2024 ended with a lot of positivity with quite a few healthtech deals closing (despite various challenges with deal delays, counterparties getting cold feet and a harder sales environment). Results so far for this year show good growth - we hope the momentum carries through to the rest of the year.

~ Ben Armstrong

Managing Partner, Archangel Ventures

It was exciting to see AI drive innovation across so many healthtech startups funded in 2024. I believe AI has huge potential to enhance patient care and assist doctors, and that Australia has unique advantages and market dynamics that will allow us to lead in this space. At Five V, we’re excited to back companies improving healthcare delivery in medical practices and hospitals.

~ Chris Gillings

FiveV & Cut Through Ventures

It's been a challenging few years for health tech companies (steep correction in public valuations, lower funding activity and tighter budgets across both consumers, and payors / enterprises / clinicians) but we remain cautiously optimistic for 2025. We're seeing startups that are leveraging AI not just for incremental efficiencies, but fundamentally redesigning care pathways to deliver continual, deeply personalized care, at a fraction of the cost

~ Sally Yu

King River Capital

⭐️ Key Takeaways

TLDR - Theres a lot of exciting things happening in Aussie healthtech with in particular, biotech, and some consumer/connected health plays showing a lot of promise. With AI and other tech unlocks accelerating development in many areas.

Theres a lot of progress (yay), with more funding, focused capabilities, industry & government getting in the game, and strong research plays. But still a long way to cement ourselves as a world leading healthtech player with capability and capital - with needs for more commercial talent and growth capital.

If theres one thing thats for sure - its no easy solve. But health is the greatest investment we all can make - for ourselves and others.

(Not to mention - commercial gains if we do it right too).

Big shoutout to the legends at Cut Through Venture and Folklore who made this report possible👀 What do you think?

Got thoughts? Feedback?

💌 Hit reply or reach out to emily@whatthehealth.io to let us know

I reply to every newsletter reply

💰Curious about funding or raising for a health/biotech company?

Hit me up at ecasey@tenmile.com

👋 Emily

With thanks to our partners 💜

Want to get featured here in front of >8850 health-loving legends?

Shoot us a note for ad placement and partnership opportunities.