What the F is going on with Funding?

With US$30B raised in just 3 quarters, healthtech really is the new fintech

Ah, my favourite F word. Funding is the flavour of the month.

Pre warning - this piece is full of investing related bits and bobs, and a bit (extra) nerdy

But first…

If you’re keen on keeping up with the latest healthtech insights (ft. fab gifs) and want to join a motley crew of other healthtech lovers, hit that subscribe button! 😊 🍩

TL;DR: Healthcare & Healthtech is a HUGE opportunity… and the fun is only just getting started

As you might have seen, venture, tech funding, and healthtech is on fire.

Ok, maybe not healthtech in Aus… yet… but I believe in us 😉

And two of the best in the biz - Rock Health & Startup Health, just released their quarterly reports. So here’s a few takeaways and insights so you don’t have to read it all.

Startup Health’s Headline…

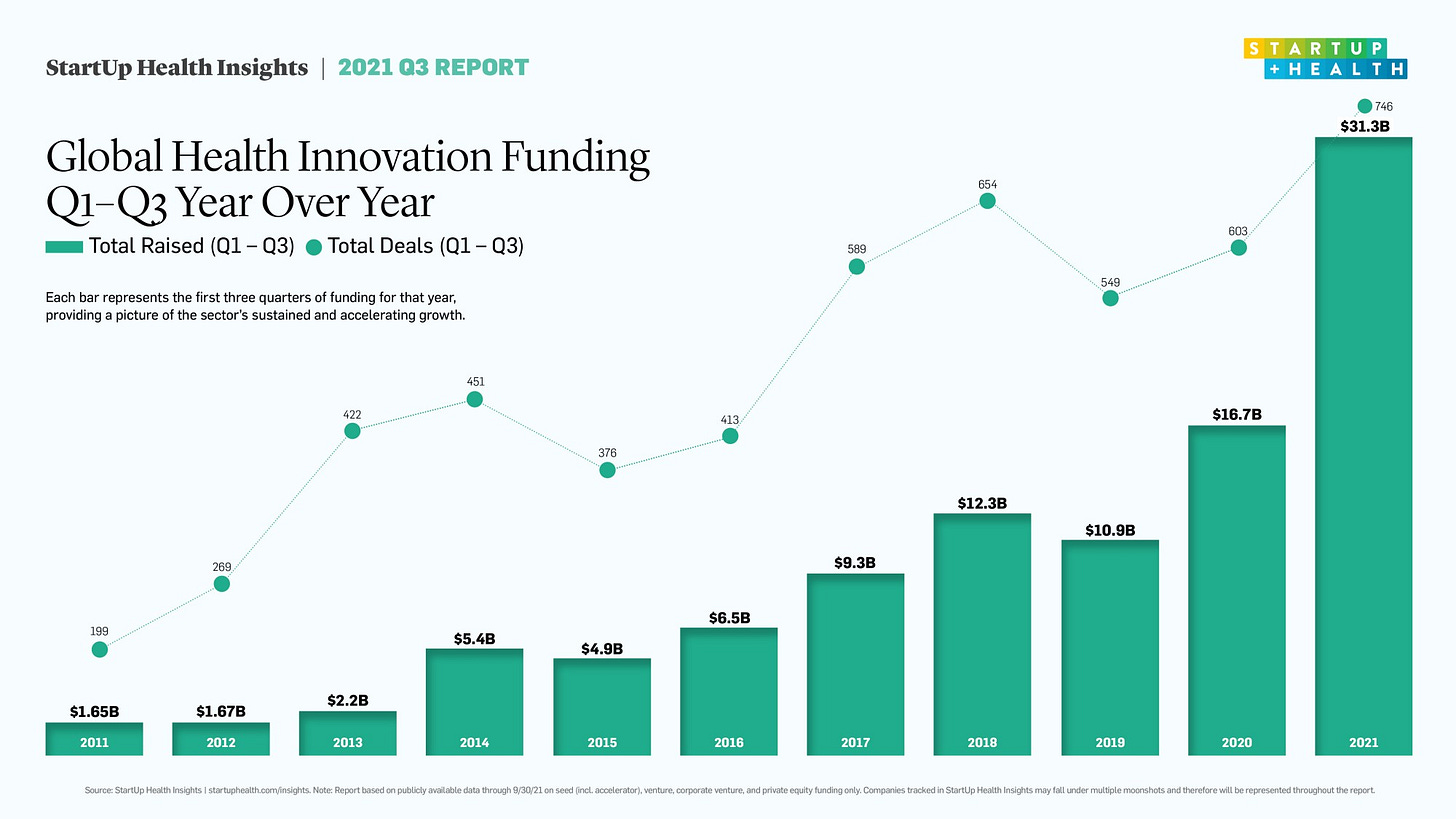

“With $30B+ Raised in Three Quarters, Global Health Innovation Funding Is on Pace for 100% YOY Growth”

Basically, Health startups are getting a lot of funding right now.

Ok, the charts…

Note: Figures quoted are (mostly) USD

It’s no surprise with the non-stop daily announcements of raises, but still, $30b is an impressive figure. And a clear indication of the market’s interest, the mass availability in funding, and perhaps growing maturity of the health market and investors. Predictions reckon the year will end at a total of ~$40b globally (Startup Health).

Finally, the funds are starting to match what is actually needed to start to see change. It’s about time it’s being taken more seriously and as the trillion-dollar opportunity, it is (even if it’s a darn tricky one).

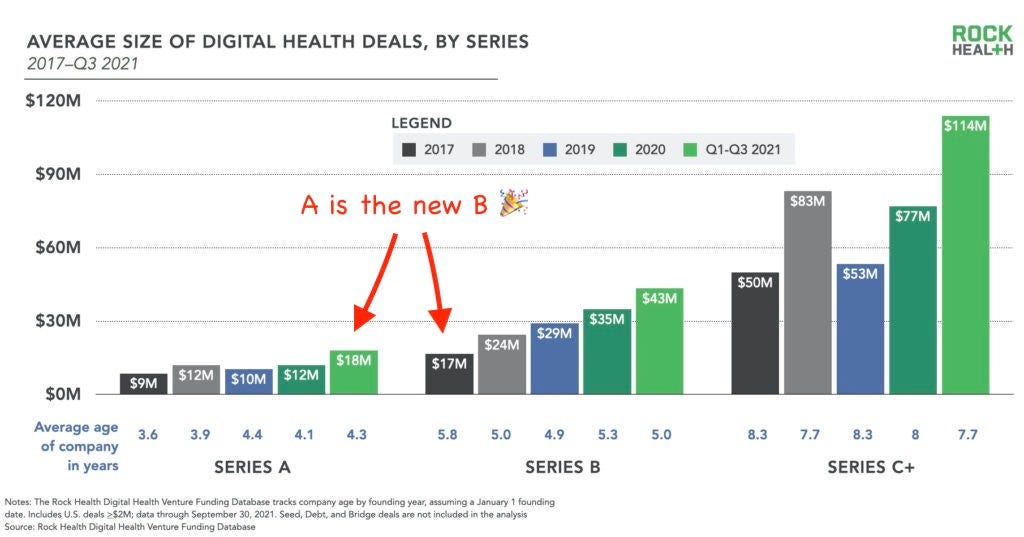

Other interesting stats - though money in is increasing (3x in average deal size in 4 years), the number of deals hasn’t changed all that much (see below).

Side Note: In September, Aus also had its biggest-ever month of capital raising with more than AUD$1.5billion poured into startups from VCs and investors. Woahhhh.

It’s nice to see more of that being directed into health like in Prospection’s $45m (AUD) Series B, Mables $100m and I’m sure we’re set to see a few more in Q4 😉

Ok, back to the global reports…

The Biggest Deals Were in the US (Shock)

Followed by China, UK, India, Germany, with SquarePeg’s portfolio companies Aidoc (Israel) & Doctor Anywhere (Singapore) sneaking into the top 10 non-US deals.

So, What’s Hot in Healthtech? At Least in Investor’s Eyes

Infrastructure

AI… for drug development… and everything else

Preventative care

Patient Empowerment

Research acceleration

Combined “ecosystems” and “omnichannel approaches”

Interoperability has been the ultimate buzzword so it’s nice to see that there’s been the realisation that in order to make that happen, we first need a solid base infrastructure. So there’s been a big focus on “pipes and roads” or foundations of healthcare. As well as smoothing out arduous admin and workflows.

The biggest deal of them all - Commure raised half a billion dollars for its “FHIR-compliant development platform for health systems, vendors and startups” (read - interoperability software) and “With its API and data services… represents an investment in an ecosystem of innovation, not just one point solution”. Cool

Another Exciting One to See… “Redesigning Models of Care”

Because it’s really where we have to go in order to succeed.

The way a large portion of digital health and healthtech has been operating so far is simply taking old workflows and making them digital. Or, adding tech components to old, already struggling, overloaded systems and ways of working.

This is not innovation. And a recipe for disaster. Not how the system will survive, upgrade and thrive going forward. Redesign is the future (easier said than done, but still).

Minds Matter

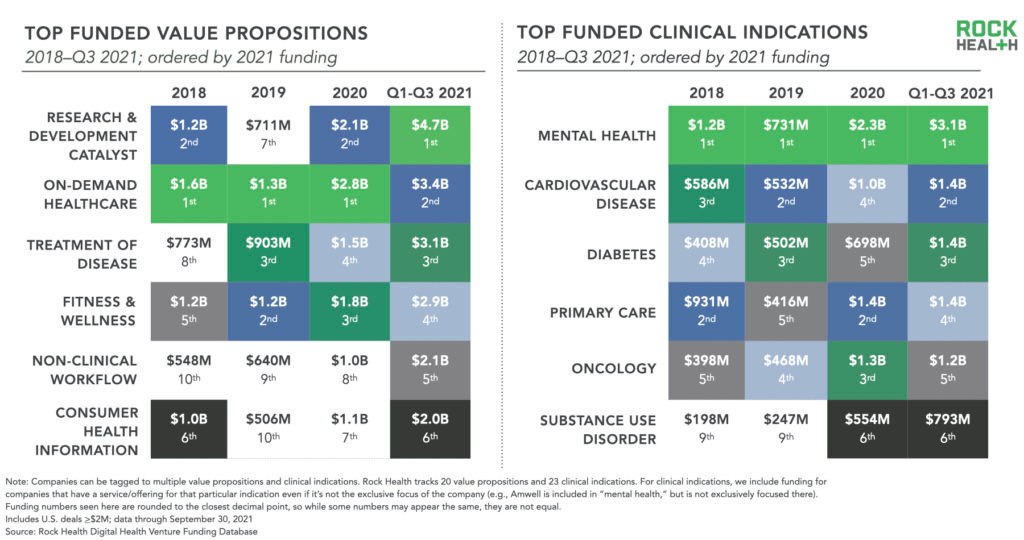

Rock Health reports mental health as the hottest therapeutic area for funding. And as it’s getting a little crowded there’s a big push for differentiation and into “complex mental and behavioural health support” - i.e. incorporating things like proper end to end care and behavioural hooks. Including a new (monetary) interest in specific conditions including substance abuse, addiction and OCD.

The Female Factor

Female CEOs have closed the most private market digital health deals on record, with $3b raised across 103 deals. But, they’re still raising far less on average than men ($29m vs $42m average check size) and account for only 14% of deals 🤦♀️

Not. Good. Enough.

On an apparant positive note - women’s health is on the rise with 2.3x more funding than this time last year. Given it’s still more than half the population, the figures are still disappointing. But big thanks to the boss companies leading the way - Maven ($110m), TMRW ($105m), and Woebot ($90m).

Fun fact… Though all these funds are flowing in the US, the evidence and/or traction behind these startups are sometimes pretty sparse

Say what?

Well, at the end of the day it’s a marketing game. And of course a markets game.

The funny thing is when you look through some of the decks, their traction, proof points and customer base is a little lacking, and often a lot less than many Aussie Stats. No wonder that Aussie companies often go abroad to “succeed”.

But what they do have going for them - is more openness and channels for innovation, and obviously access to funding. So it’s a tad easier to get in and going. Not to mention the market size ft. private payers.

This highlights our massive gap in pre-seed and seed funding, and consequentially, possibilities for our companies.

The US are pumping billions each month into new funds for early and seed-stage ventures just for this purpose - like Greylock’s $500m and a16z’s $400m new funds ft. a global remit.

And this is just the beginning… wait till everyone else gets in the game…

With more money available (and optimism) valuations continue to soar higher, so too do check sizes. And, companies are getting in earlier for funding.

Top Dawgs

Speaking of which, it’s fun to see some of these funds… and other big names, now turning their eyes to Aus. Not only seeking investors, but investments.

Unsurprising, given compared to the US, our valuations are still considered “somewhat reasonable”. It’s not only Aus, but also other smaller, traditionally “undervalued” markets including India, Pakistan & Asia.

This year we’ve seen the likes of Eucalyptus & Mindset Health snag strong US backers, and I’m sure this trend is set to continue… And at increasingly earlier stages.

Aussie investors - Might need to pick up our game in order to stay in it.

And founders - I know we all want to improve things here, but sometimes, for survival and scale, international pathways and people are something to consider.

My hope (ok, it’s a loon shot) - but one day, Australia will get its act together and make this list.

We’ve got the medical and science chops. So it would be great if we could capitalise on this and share it with the world. But also fab if we could help fund and foster it here too.

Streamline and Integration Is the Name of the Game…. Also Known as Mergers & Acquisitions

Somewhat surprising - Aus made it into the top M&A activity of the quarter out of over 48 recorded deals. Dangggg.

Get-togethers are trending. Thank goodness.

Companies are raising then buying out competitors, or consolidating. Well, if it already exists and is complementary, why not. Eucalyptus has been building it’s “House of Brands”, Telstra Health is on a spending spree, and others like Midnight Health, Mosh and Honeysuckle Health seem to be on a similar path.

Both patients and professionals are overwhelmed, so, consolidation, at least in some cases, makes sense.

If only the government could get on board and stop all this double up nonsense, and utilise some of the great solutions that already exist…

Something to keep in mind…This report is just on startups and newbies on the scene

And don’t include the billions flowing through the big dogs.

Behind the scenes, though there’s been a lot of talk of “Big Tech” b****ing out of health. Oh, the media… 🤦♂️ It’s simply not true.

Apple is continuing to roll out new features almost weekly. Google is going at the game from a few interesting angles. AWS finally launched their suite of health products previously only available in the US, globally. Microsoft is loved by many in the industry and going hard at hospitals with partnerships for integrations.

Not to mention Cerner, Epic and the other traditional big healthtech titans.

But more on all that another time…

Is This a Bubble You Ask? Maybe… But I Don’t Think So.

There might be some speed bumps, but long term, health will continue to trend.

Why?

Every company is becoming a health company - Whether directly or indirectly

Healthtech & healthcare will be a key theme, at least for the next decade - It affects literally. Every. Human. And there are gross disparities that will only get worse. Similar to the climate movement, health is next.

There is SO much money to be made - With lots of problems come possibilities for solutions. Healthcare is big business. And this technological revolution is just getting started.

More people are getting in the game - with startup and tech investing said to become the new Wallstreet (ok, I know crypto is giving it a good go too). There’s lots of enthusiasm and eagerness to invest…

And health is heating up… PE is pouring in with new funds in the wings. Traditional funds have turned their gaze. More people are not only taking up angel investing and joining syndicates, but “crowdfunding” is becoming more mainstream and accessible and sure to enter this arena more soon. Even DAOs have a big possibility to come into play and let more people in the game.

P.S. - This podcast 🔥👇

But what about what really matters?

Yes, funding is nice. But we all know at the end of the day, what really matters is the impact it has on patients, professionals, and health outcomes.

Obviously, funding is (often) necessary, and in this previously neglected industry, it’s darn exciting to see more traction. At least abroad. But it’s just a part of the journey, and a means to an end. And important to keep our eyes on the prize.

But, if you play the game well - you can probably make a whole lot of money AND make a big difference. Yay!

*Disclaimer - As always this is not investment advice and you probably shouldn’t listen to anything I say… I sure wouldn’t listen to me

Reports to Read 📚

Rock Health’s Q3 2021 digital health funding Report: To $20B and beyond!

Startup Health Insights - 2021 Q3 Global Health Innovation Funding Report

Renowned investor Kevin Ryan thinks the big money is in healthcare - don’t just take my word for it

Until next time

👋 Emily

Supported by

Need to be made clear that the ‘housing estate’ if brands including the nib example are simply skimming the healthcare/delivery/outcome space. These sirens are not doing anything significant for people with real healthcare challenges - meaning, the real frequent flyers of expensive care, the ones that are left behind. That needs to be accepted across the board and not deflected by ‘it will come’ rhetoric. Many people don’t have the luxury of eating for ‘it’ to arrive.

Also, this piece should highlight to readers that that despite the success of the ‘old school’ system, it also demonstrates Australia is becoming more isolated, rapidly becoming an also ran in terms of actually using any tech that’s developed...